What/How Series (4 of 6): Public Equity Markets

“When Clay describes a challenge, he applies a logic that is both compelling and forceful. We were talking about the North Atlantic Right Whale: facing extinction and the bane of Maine lobstermen. Collisions at sea and gear entanglements are stymieing the species’ capacity to restore itself. We were standing by the shore talking about scarcity and responsibility. I realized that we weren’t going to find common ground today.”

In the last few blog posts we have explored the mechanics of our investment process. In this post we want to explore some examples to get into the details of that investment process: describing specific steps that we are developing. To frame the discussion let’s consider two contexts: publicly traded investments and private investments (where forfeiture of liquidity creates the opportunity to generate outsized financial and non-financial returns relative to liquid investments.) While TILT portfolios will have a high concentration of illiquid, private holdings, we apply our multi-capital investment process to the public markets too. In both market contexts we are striving for financial and non-financial returns that meet our client’s needs – we are not competing against benchmarks and peer universes. Across all asset classes, in all market contexts, we apply the same framework.

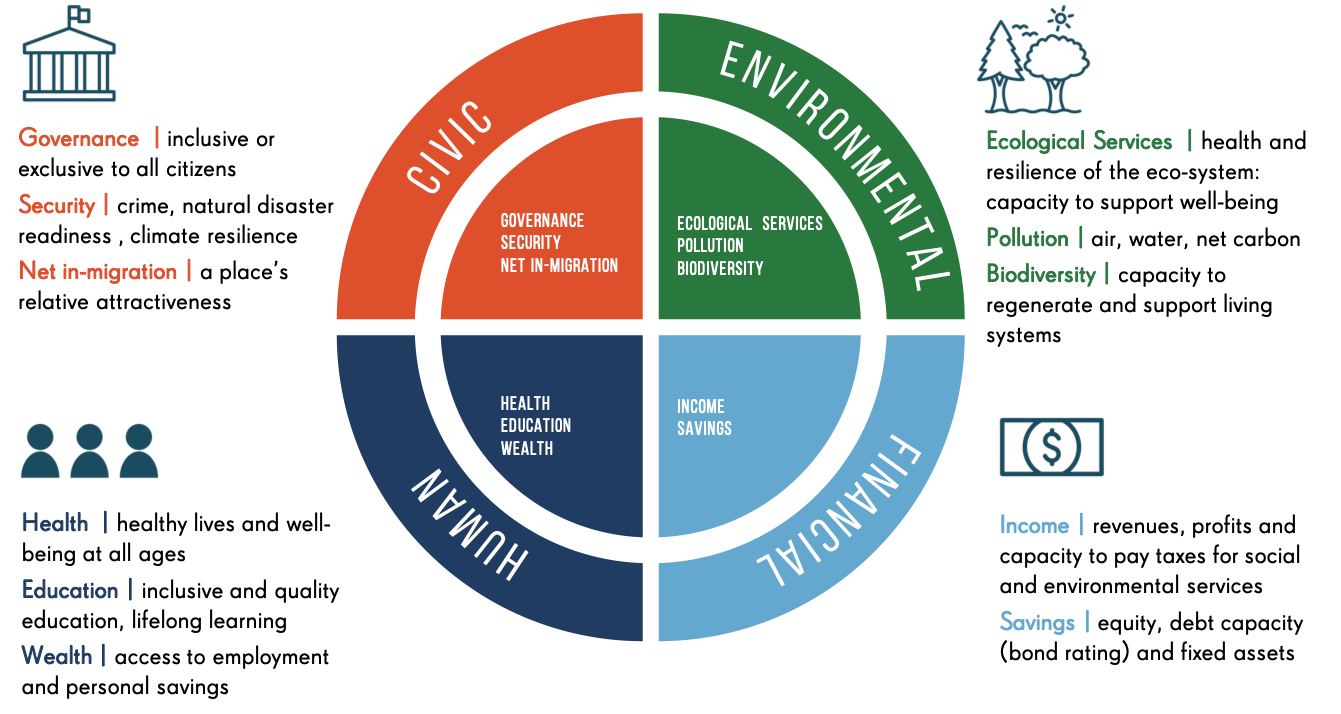

Grounded in the Sustainable Development Goals

The first level of our multi-capital framework draws from a globally “crowd-sourced” set of goals: the Sustainable Development Goals. We look into this framework to determine the critical factors within our multiple capital framework:

This alignment focuses our client’s investments alongside government policy goals and other social and environmental investors. This kind of focus and sustained commitment increase the probabilities of achieving a wide range of social and environmental development goals.

In public market investing, with both equities and fixed income securities, we have less ability to forge a strong relationship with the management teams. In our private market investments we can develop this rapport and discern the nuanced reporting we use in forecasting non-financial returns. In the public markets, with less access to management and less influence to develop shared measures to support our multi-capital framework, we need to develop alternatives to forecast civic, environmental, financial and human capital returns. Absent reported data sets from management, we are developing an investment practice that analyzes “proxy factors.” This means we take publicly available information from company filings (e.g., 10Ks) and from alternative data sources to build predictive models within each of the four capitals. We use these forecasts (within each capital) to compare investable securities to be able to construct portfolios aligned with our clients’ goals. As we discussed in the last blog post, this capacity enables us to make active trade-offs between the capitals in optimizing to a client’s unique goal.

Non-Financial Capital Forecasts: Proxy Factors in the Public Markets

The business of measuring non-financial returns is highly subjective. When we are navigating these nuanced measures in the private markets, we can discern the overlapping interests between the investor, the community, and the enterprise. Moreover, we can support the complex interplay within each of the capitals based on multiple sub-factors. In the public markets where we are creating proxy factors – this is more difficult. Let’s consider two proxy factors that we developed. These examples illuminate the nature of our thinking: one related to human capital and the other related to environmental capital.

Human Capital. We are developing a healthcare proxy as part of our human capital forecast. When we evaluate a group of companies in the healthcare sector: e.g., pharmaceutical businesses, device makers, etc. we can access information about their current products and those in the development pipeline. These products (the source of current and future revenues) represent the “purpose” of the enterprise and we can build a prospective profile of their business mix. By integrating this outlook with the World Health Organization’s Disability-Adjusted Life Year (DALY) Indicators, we get a powerful and objective measure to forecast human capital for a particular cluster of companies.

Environmental Capital. We are developing a measure that looks across the universe of investable companies through the lens of “carbon intensity.” We have created a metric by aggregating an enterprise's carbon emissions based on output and input (Scope one and Scope two) divided by the annual revenues. Through this measure we create a forward-looking forecast for environmental capital with which we can rate a broad universe of tradable securities.

We are applying this technique to populate each of the sub-factors within each of the four capitals. Some are narrow (applicable to a subset of companies) others are universal (applicable across the broad universe of opportunities.) These insights will enable us to scale across a large universe of publicly traded enterprises: in both the equity and debt markets. In the first example, we are pulling data from company 10-K filings and the World Health Organization. In the second example we are pulling data from 10-K filings and the Carbon Disclosure Project. In these and other examples, we are creating insight from publicly available information to develop a proxy factor. We will apply these proxies in an optimization process that allows us to build unique portfolio solutions for unique client objectives. In the next post we will explore how we approach private market investments. - applying the same framework, but gaining insights without having to go through a process to create the proxy factors.

“Clay defended the fisherman’s right to set their gear to earn their livelihood, explaining that families along the coast of Maine were dependent on that income. COVID and trade wars with Europe and China have conspired to crush demand for Maine lobsters. Meanwhile NOAA estimates that there are 400 whales left, 100 breeding females and crashing birth rates for these overstressed giants. Regeneration of capital is going to be hard work – how do you want to show up for these kinds of conversations?”