What/How Series (3 of 6): TILT's Multi-Capital Framework

“I was talking with my mother in law, Joan, about how TILT works. Joan was born and raised in Nashville, TN – she lives there today. She is alarmed at the state of the world, and genuinely concerned for her grandchildren’s future amidst the convergence of structural racism (exposed in the civil unrest), theCOVID-19 pandemic, and the global crisis around climate. Regenerating civic, environmental, and human capital sounded interesting, she wanted to understand how that worked.”

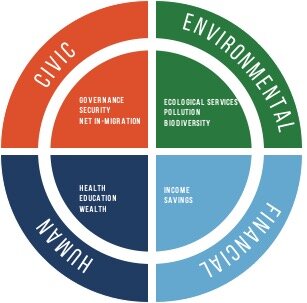

In the last few blogs we have talked about the limitations of ESG investing, and critiqued the constraints of relative return measures (benchmarks, etc.) Today we are going to explore the foundation of our thinking (the multi-stakeholder framework) and the practical aspects of our investment process (the multi-capital framework). As we have stated previously, TILT is working with its clients to apply some time-tested investment techniques in a radically different way in order to deploy capital to those enterprises that are actively regenerating the capitals that have been depleted: civic, environmental, financial, and human.

How do you know if your investment generates non-financial return? TILT seeks to measure how an enterprise affects the larger community that it touches. This requires us to focus on the outputs and outcomes of an enterprise (e.g., the goods and services that it produces/provides), alongside the inputs (e.g., supply chain.) We define “community” in terms of people (who), place (where), and theme (what). A thematic example is the community of people and enterprises who are actively seeking a vaccine for COVID-19. Oftentimes these definitions of community are overlapping: e.g., when a client targets non-financial returns amongst a group of people in a particular geography with a focus on worker housing. Each of our clients has their own unique definition of community and we work with them to identify the persons within a community who can serve as change agents (e.g., business leaders, elected officials, and faith leaders) - people who can both speak for a community and drive change. We define these people in our lexicon as community agency partners.

TILT works with our clients to build a relationship of trust and confidence with these agency partners. Our goal is to establish a shared understanding of the capital deficits and surpluses within a specific community that shapes the goals and priorities for investment. We do this by executing a capital scan. We can forge alignment between our clients, the community (via agency partners), and the enterprises (potential investees) to develop effective measures. These measures serve as a feedback mechanism during the investment period and provide critical attribution to evaluate both enterprise level and portfolio level returns across the multi-capital framework. While we apply this logic across all asset classes, we will have a much more detailed and nuanced level of alignment through holding private, illiquid investments than we will from holding publicly traded shares and bonds. We call this TILT’s multi-stakeholder framework.

Power is distributed between the investor and the community; this mutuality defines whether and how an investment does or doesn’t generate the financial and non-financial returns that we are seeking.

The specific outputs and outcomes that a community seeks for itself is complex and dynamic. This complexity, and the unique nature of each community, invites us to develop a highly bespoke set of tools. At the same time, each investor brings his/her unique point of view to generating non-financial return. In order to manage this complexity, TILT applies a simple framework that we call the multi-capital framework.

Investment decisions require us to evaluate each potential enterprise with consistent tools and replicable processes. We apply a multi-capital framework to discern how each investable enterprise is consuming or creating each of four capitals: civic, environmental, financial, and human. By measuring the outputs and outcomes at the enterprise level and at the portfolio level, we are able to report success and failure to create positive change at the community level. While some might argue for more capitals than the four we have selected, adding additional capitals adds complexity to the analytical challenge. These four provide a holistic frame to evaluate the well-being of a community and to enable each client to develop a highly customized approach to their investment practice.

From an investor’s point of view, we are able to provide a trade-off mechanism. For example, if a client has a targeted financial return of five percent and seeks to improve the well-being of those people living in a place – an investment that has outstanding human capital returns within the selected geography that only generates a three percent return may not be attractive. Similarly, and staying with the same hypothetical client, an affordable housing investment that will impair a sensitive ecological area can be evaluated with a measurable trade-off between the human and environmental capital returns. This analytical flexibility is far more accessible with the private investments than with the public market ones because of the closer alignments investors can create with enterprise management through private investment structures .

From a community’s point of view, we are able to target the enterprises that are aligned to their priorities. Moreover, we can evaluate both the individual enterprise and the portfolio’s aggregate impacts on a community over time. This feedback is a critical dimension to understand both whether and how a series of integrated investments is affecting the community. Most of TILT’s clients will hold public market exposures alongside their private market holdings. Publicly traded companies have direct impacts on communities, though we won’t have the same influence on their performance within the community context.

Our investment process up-ends contemporary theories and models such as Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM) – to move beyond ESG investing’s narrow focus on maximizing risk adjusted returns. We are targeting real, measurable return as “experienced” by the communities where our clients are seeking to support sustained, systemic change. Our clients don’t need a third party to “qualify” their non-financial returns. We embrace the challenge of meeting each client’s liquidity, risk and return constraints by working closely with our clients, by investing across all asset classes and by developing deep knowledge and understanding of the potential alignment between the enterprise and the community.

Next week we will delve into each of the four capitals to highlight the insights we are developing. If any part of this overview of “how” piques questions and comments – we welcome them!

“Joan and a partner launched a bail fund in Nashville four years ago. The Nashville Bail Fund has enabled more than one thousand Nashville citizens to keep their lives on track. The human and civic returns from this investment are enormous as measured by the community. Joan appreciates the power of aligning with the community’s goals. I don’t think trash talking CAPM and MPT helped Joan to understand how TILT works – but I think that she is a believer in the approach!”